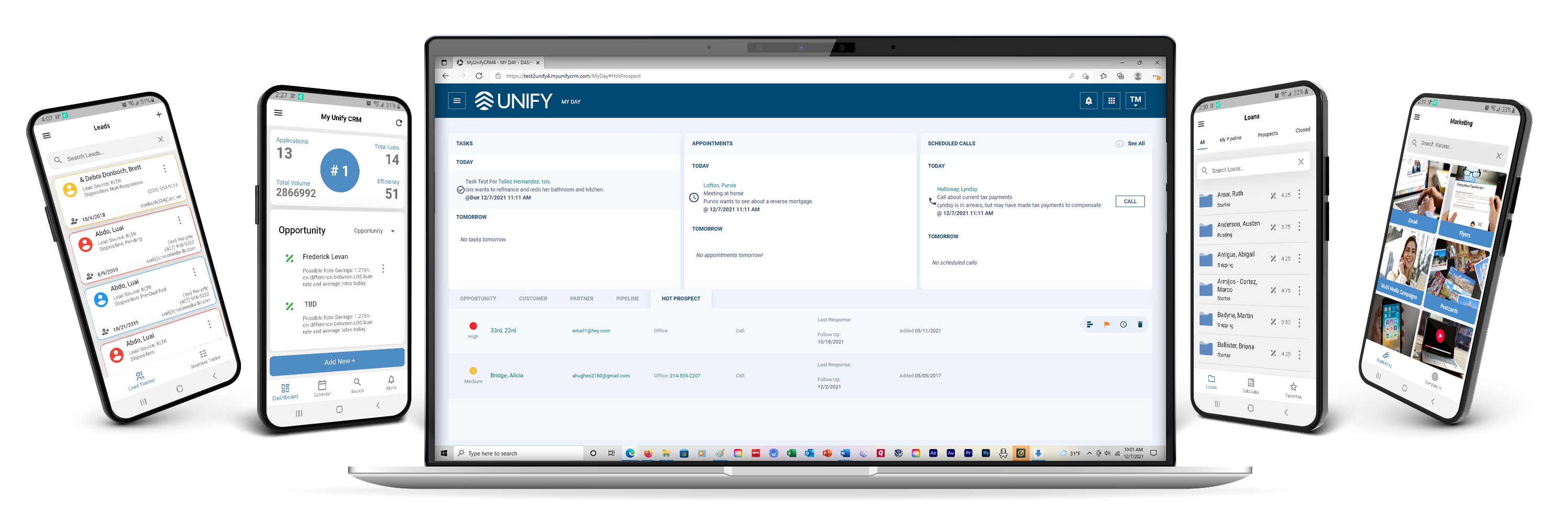

All in one

mortgage CRM.

Unify gives top mortgage professionals the tools needed to grow their business. Manage key relationships, send marketing campaigns, and track leads — all in one place built specifically for mortgage professionals.

4,000+

USERS

1M+

LOANS IN PROGRESS

$47B+

LOANS CLOSED

What can UNIFY do for you?

Growing your mortgage business takes time. But as a top mortgage professional, you may not have time. That’s why we made Unify, for busy mortgage leaders like you. Unify is the best mortgage business growth platform that can help you create more lending opportunities and manage them more efficiently. See for yourself today.

Contact Organization

- Schedule appointments, tasks, and calls

- Organize contacts into identifiable groups

- Track past communication touchpoints

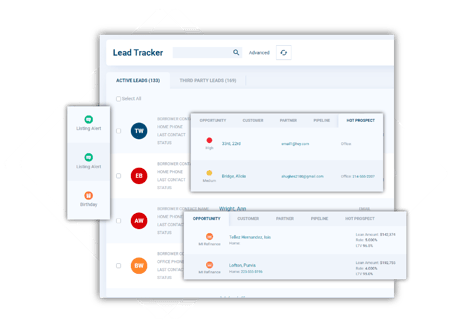

Lead Generation

- Receive leads through multiple integration sources

- Manage outreach efforts for prequalified mortgage leads

- Set up automated lead responses within one system

Marketing Automation

- Create automated co-branded marketing campaigns

- Personalize content for every step of the customer journey

- Utilize multiple marketing channels (email, video, text message, voicemail, direct mail)

UNIFY is a full-suite, full-lifecycle mortgage CRM solution

Tools built to solve your unique problems. All included.

Being a mortgage professional is hard. We want to make it easier. That’s why we used our in-depth understanding of the unique demands in your industry to build all the mortgage CRM tools in Unify. It’s also why we include them all in one easy-to-use cloud-based system.

Referral Partner Management

Lead Tracking and Management

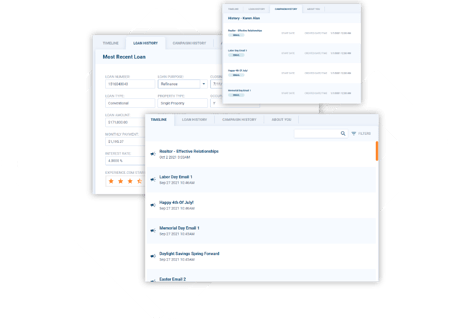

Real-Time LOS

Integration

Automated and Post-Close Marketing

Let's Talk About How UNIFY Can Help You

We understand your mortgage business. After all, we're in it. We're here to help in any way that we can. Chat with one of our Mortgage CRM experts to get started on your unique Unify journey.

Who uses UNIFY?

Unify's Mortgage CRM is a dynamic, cloud-based customer relationship management tool designed to cater to a wide range of professionals in the mortgage industry. Its primary users encompass mortgage lenders, credit unions, banks, and mortgage brokers, each benefiting from tailored solutions that address their specific operational needs.

Mortgage Lenders

- Introduce innovative technologies that are easy to use and provide value to users at all levels

- Implement a seamless setup and integration with your core systems

- Structure the software to automate unique workflows

- Adhere to your company’s security and compliance with built-in audits and approvals

- Ensure your business is always operating at the highest level with prompt customer service and app access

Banks

- Facilitate effortless integration with existing banking systems, ensuring a smooth and uninterrupted transition

- Customize the software to automate specific banking workflows, increasing operational efficiency

- Prioritize security and compliance in banking operations through robust built-in audit and approval processes

- Guarantee optimal operational performance with rapid and reliable customer support, along with convenient application accessibility for banking needs

Credit Unions

- Ensure smooth and efficient integration with the credit union's existing systems for a hassle-free setup experience

- Customize the software to specifically automate and streamline credit union workflows, enhancing operational efficiency

- Maintain stringent security and compliance standards for the credit union, complete with comprehensive audits and approval mechanisms

- Uphold the highest operational standards with immediate customer support and easy access to applications, ensuring the credit union's services are always top-notch

Mortgage Brokers

- Tailor Unify to specifically automate your brokerage workflows, thereby enhancing the efficiency and effectiveness of your sales process

- Emphasize stringent security and compliance measures within the brokerage operations, backed by comprehensive internal audits and approval protocols

- Provide mortgage brokers with top-notch operational performance, supported by prompt and dependable customer service, along with easy access to essential applications tailored to their brokerage needs

BUILT IN MORTGAGE COMPLIANCE

with SOC 2 Type 2 Certification

UNIFY Client Success

Delivering results for mortgage professionals for over 10 years.

“Unify is the bomb. One LO has gotten $1.5m from Unify in past month. Every LO needs to be paying attention!”

“Thanks again for being so responsive! Your team is the lifeblood of your company! I hope you all know that, and I hope it brings you all some satisfaction when times are hard. You all do a great job and I am grateful for all you do!”

“I’m liking this very much. Very very very much. To do what you just did, I was using 3 separate programs and tying it all together and….it was not fun.”

UNIFIED access at your fingertips